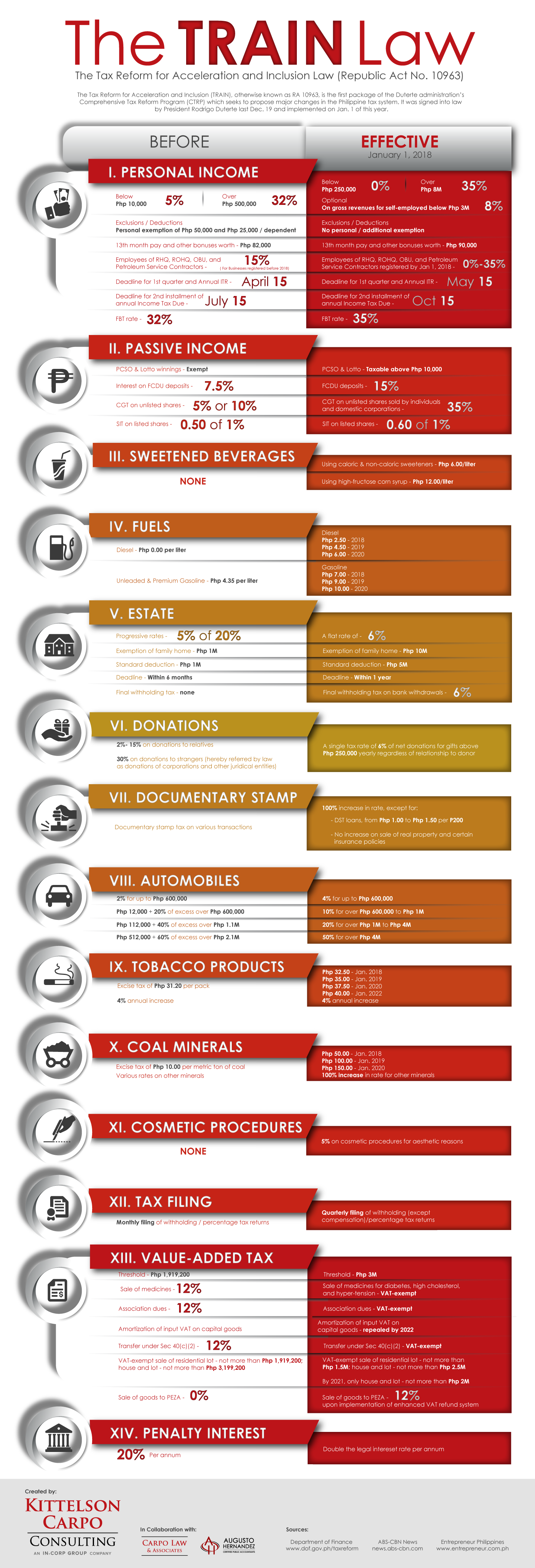

The Tax Reform for Acceleration and Inclusion Law (Republic Act No. 10963)

The Tax Reform for Acceleration and Inclusion (TRAIN), otherwise known as RA 10963, is the first package of the Duterte administration’s Comprehensive Tax Reform Program (CTRP) which seeks to propose major changes in the Philippine tax system. It was signed into law by President Rodrigo Duterte last Dec. 19 and implemented on Jan. 1 of this year.

Before: I. Personal Income

- Below Php 10,000 – 5%

- Over Php 500,000 – 32%

- Exclusions/Deductions- Personal Exemption of Php 50,000 and Php 25,000/dependent

- 13th month pay and other bonuses worth – Php 82,000

- Employees of RHQ, ROHQ, OBU, and Petroleum Service Contractors – 15% (For Businesses registered before 2018)

- Deadline for 1st Quarter and Annual ITR – April 15

- Deadline for 2nd installment of Annual Income Tax Due – July 15

- FBT rate – 32%

Effective: I. Personal Income

- Below Php 250,000 – 0%

- Over Php 8M – 35%

(OPTIONAL: On gross revenues for self-employed below Php 3M) - Exclusions/Deductions- No Personal/Additional Exemption

- 13th month pay and other bonuses worth – Php 90,000

- Employees of RHQ, ROHQ, OBU, and Petroleum Service Contractors registered by Jan. 1, 2018 – 0%-35%

- Deadline for 1st Quarter and Annual ITR – May 15

- Deadline for 2nd installment of Annual Income Tax Due – Oct 15

- FBT rate – 35%

Before: II. Passive Income

- PCSO & Lotto Winnings – Exempt

- Interest on FCDU deposits – 7.5%

- CGT on unlisted shares – 5% or 10%

- SIT on listed shares – 0.50 of 1%

Effective: II. Passive Income

- PCSO & Lotto Winnings – Taxable above Php 10,000

- FCDU deposits – 15%

- CGT on unlisted shares sold by individuals and domestic corporations – 35%

- SIT on listed shares – 0.60 of 1%

Before: III. Sweetened Beverages

None

Effective: III. Sweetened Beverages

- Using caloric & non-caloric sweeteners – Php 6.00/liter

- Using high-fructose corn syrup – Php 12.00/liter

Before: IV. Fuels

- Diesel – Php 0.00 per liter

- Unleaded & Premium Gasoline – Php 4.35 per liter

Effective: IV. Fuels

- Diesel

- Php 2.50 – 2018

- Php 4.50 – 2019

- Php 6.00 – 2020

- Gasoline

- Php 7.00 – 2018

- Php 9.00 – 2019

- Php 10.00 – 2020

Before: V. Estate

- Progressive rates – 5% of 20%

- Exemption of Family Home – Php 1M

- Standard deduction – Php 1M

- Deadline – within 6 months

- Final Withholding tax – none

Effective: V. Estate

- A flat rate of – 6%

- Exemption of Family Home – Php 10M

- Standard deduction – Php 5M

- Deadline – within 1 year

- Final Withholding tax on bank withdrawals – 6%

Before: VI. Donations

- 2%-15% on donations to relatives

- 30% on donations to strangers (hereby referred by law as donations of corporations and other juridical entities)

Effective: VI. Donations

A single tax rate of 6% of net donations for gifts above Php 250,000 yearly regardless of relationship to donor.

Before: VII. Documentary Stamp

Documentary stamp tax on various

Effective: VII. Documentary Stamp

100% increase in rate, except for:

- DST loans, from Php 1.00 to Php 1.50 per Php 200

- No increase on sale of real property and certain insurance policies

Before: VIII. Automobiles

- 2% for up to Php 600,000

- Php 12,000 + 20% of excess over Php 600,000

- Php 112,000 + 40% of excess over Php 1.1M

- Php 512,000 + 60% of excess over Php 2.1M

Effective: VIII. Automobiles

- 4% for up to Php 600,000

- 10% for over Php 600,000 to Php 1M

- 20% for over Php 1M to Php 4M

- 50% for over Php 4M

Before: IX. Tobacco Products

- Excise tax of Php 31.20 per pack

- 4% annual increase

Effective: IX. Tobacco Products

- Php 32.50 – Jan 2018

- Php 35.00 – Jan 2019

- Php 37.50 – Jan 2020

- Php 40.00 – Jan 2022

Before: X. Coal Minerals

- Excise tax of Php 10.00 per metric ton of coal

- Various rates on other minerals

Effective: X. Coal Minerals

- Php 50.00 – Jan 2018

- Php 100.00 – Jan 2019

- Php 150.00 – Jan 2020

- 100% increase in rate of other minerals

Before: XI. Cosmetic Procedures

None

Effective: XI. Cosmetic Procedures

5% on cosmetic procedures for aesthetics reasons

Before: XII. Tax Filing

Monthly filing of withholding/percentage tax returns

Effective: XII. Tax Filing

Quarterly filing of withholding (except compensation)/percentage tax returns

Before: XIII. Value-Added Tax

- Threshold – Php 1,919,200

- Sales of Medicines – 12%

- Association dues – 12%

- Amortization of input VAT on capital goods

- Transfer under 40(c)(2) – 12%

- VAT-exempt sale of residential lot – not more than Php 1,919,200; house and lot – not more than Php 3,199,200

- Sales of goods to PEZA – 0%

Effective: XIII. Value-Added Tax

- Threshold – Php 3M

- Sales of Medicines for diabetes, high cholesterol, and hyper-tension – VAT-exmept

- Association dues – VAT-exempt

- Amortization of input VAT on capital goods – repealed by 2022

- Transfer under 40(c)(2) – VAT-exempt

- VAT-exempt sale of residential lot – not more than Php 1.5M; house and lot – not more than Php 2.5M (By 2021, only house and lot – not more than Php 2M)

- Sales of goods to PEZA – 12% upon implementation of enhanced VAT refund system

Before: XIV. Penalty Interest

- 20% Per annum

Effective: XIV. Penalty Interest

- Double the legal interest rate per annum