SEC Implements One-Time Grace Period for Payment of All Loans in the Philippines

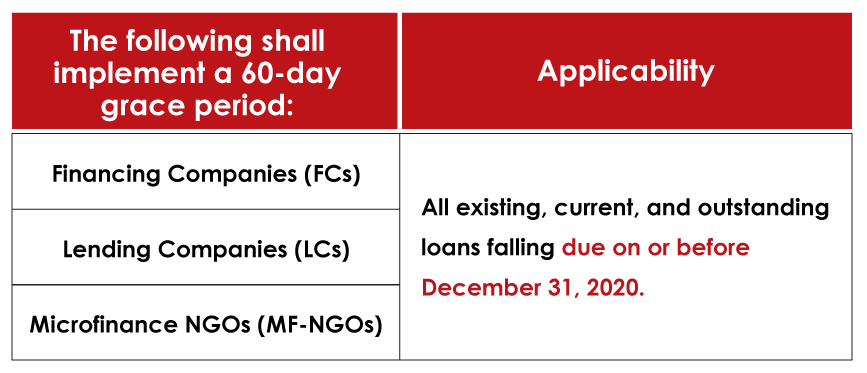

The Securities and Exchange Commission (SEC), in a public notice dated September 21, 2020, has implemented a mandatory one-time 60-day grace period covering all existing, current, and outstanding loans as a relief to borrowers pursuant to Republic Act (RA) No. 11494, otherwise known as the Bayanihan to Recover As One Act.

The implementation has directed all banks, quasi-banks, financing companies, lending companies, real estate developers, insurance companies providing life insurance policies, pre-need companies, entities providing in-house financing for goods and properties purchased, asset and liabilities management companies and other financial institutions, public and private, including the Government Service Insurance System (GSIS), Social Security System (SSS) and Home Development Mutual Fund (Pag-IBIG Fund) to ensure compliance following the execution of the government’s COVID-19 response and recovery plans.

The FCs, LCs, and MF-NGOs are barred from enjoining their clients to waive the execution of the provisions of Bayanihan 2.

ON PAYMENT OF THE ACCRUED INTEREST

Borrowers shall be allowed to pay on a staggered basis the accrued interest for the said grace period until December 31, 2020.