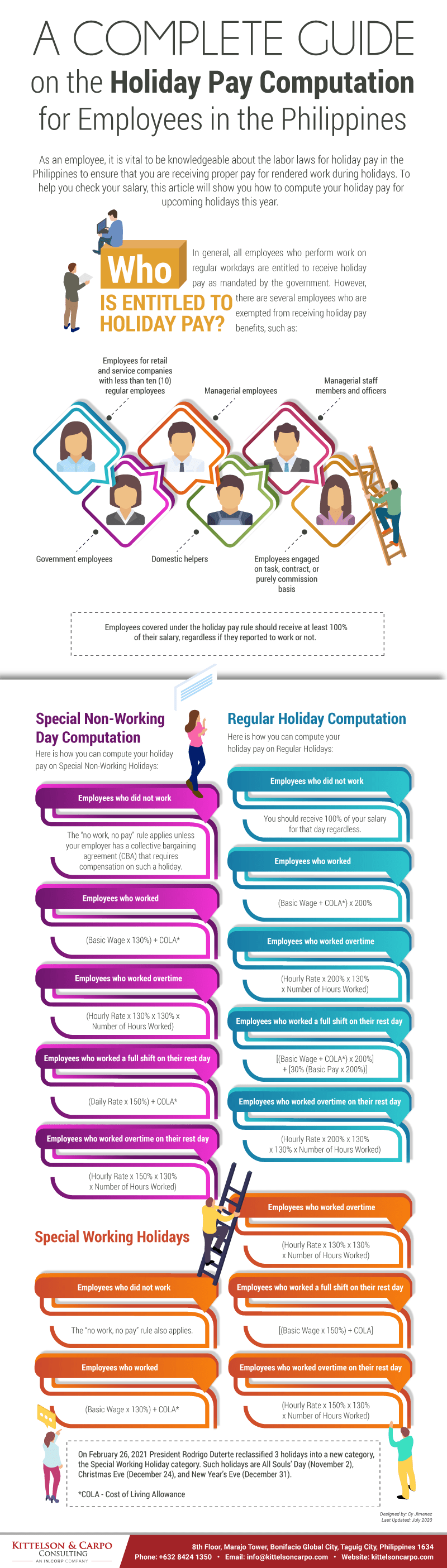

A Complete Guide on the Holiday Pay Computation for Employees in the Philippines [INFOGRAPHICS]

As an employee, it is vital to be knowledgeable about the labor laws for holiday pay in the Philippines to ensure that you are receiving proper pay for rendered work during holidays. To help you check your salary, this article will show you how to compute your holiday pay for upcoming holidays this year.

Who is Entitled to Holiday Pay?

In general, all employees who perform work on regular workdays are entitled to receive holiday pay as mandated by the government. However, there are several employees who are exempted from receiving holiday pay benefits, such as:

- Employees for retail and service companies with less than ten (10) regular employees

- Managerial employees

- Managerial staff members and officers

- Government employees

- Domestic helpers

- Employees engaged on task, contract, or purely commission basis

Employees covered under the holiday pay rule should receive at least 100% of their salary, regardless if they reported to work or not.

Regular Holiday Computation

Here is how you can compute your holiday pay on Regular Holidays:

- Employees who did not work. You should receive 100% of your salary for that day regardless.

- Employees who worked. (Basic Wage + COLA*) x 200%

- Employees who worked overtime. (Hourly Rate x 200% x 130% x Number of Hours Worked)

- Employees who worked a full shift on their rest day. [(Basic Wage + COLA*) x 200%] + [30% (Basic Pay x 200%)]

- Employees who worked overtime on their rest day. (Hourly Rate x 200% x 130% x 130% x Number of Hours Worked)

Special Non-Working Day Computation

Here is how you can compute your holiday pay on Special Non-Working Holidays:

- Employees who did not work. The “no work, no pay” rule applies unless your employer has a collective bargaining agreement (CBA) that requires compensation on such a holiday.

- Employees who worked. (Basic Wage x 130%) + COLA*

- Employees who worked overtime. (Hourly Rate x 130% x 130% x Number of Hours Worked)

- Employees who worked a full shift on their rest day. (Daily Rate x 150%) + COLA*

- Employees who worked overtime on their rest day. (Hourly Rate x 150% x 130% x Number of Hours Worked)

Special Working Holidays

- Employees who did not work. The “no work, no pay” rule also applies.

- Employees who worked. (Basic Wage x 130%) + COLA*

- Employees who worked overtime. (Hourly Rate x 130% x 130% x Number of Hours Worked)

- Employees who worked a full shift on their rest day. [(Basic Wage x 150%) + COLA]

- Employees who worked overtime on their rest day. (Hourly Rate x 150% x 130% x Number of Hours Worked)

*COLA – Cost of Living Allowance

Get the Best Computation for Your Salary Today

With a large pool of Certified Payroll Professionals, our team can assist you with your salary computations and compensation packages for your employment needs.