Our team of

EXPERTS AND PARALEGALS

can help you register your business in the Philippines

How to Register a One Person Corporation in the Philippines

Local and foreign entities seeking to set up a company in the Philippines without the need for multiple shareholders or the existence of a board of directors can take advantage of a One Person Corporation, a new type of corporation offering the benefits of sole ownership with limited liability.

What is a One Person Corporation?

A One Person Corporation (OPC) is a corporation with a single stockholder. The single stockholder shall serve as the incorporator, sole director, and president. The shareholder’s liability in an OPC is limited to the extent of their assets.

The OPC is not required to have a minimum authorized capital stock except as specified by applicable laws. Moreover, no portion of the authorized capital is required to be paid-up at the time of incorporation, unless required by special laws.

The single stockholder must appoint a Corporate Secretary, Treasurer, and other officers within 15 days from the date of incorporation. The role of Corporate Secretary cannot be assumed by the single stockholder, but they can take the role of the Treasurer provided they submit a surety bond to the Securities and Exchange Commission (SEC). Moreover, the Corporate Secretary must be a Filipino citizen while the Treasurer must be a resident of the Philippines.

The single stockholder is also required by law to appoint a nominee and an alternate nominee who shall be indicated in the Articles of Incorporation to replace the single stockholder if they die or become incapacitated to operate the OPC.

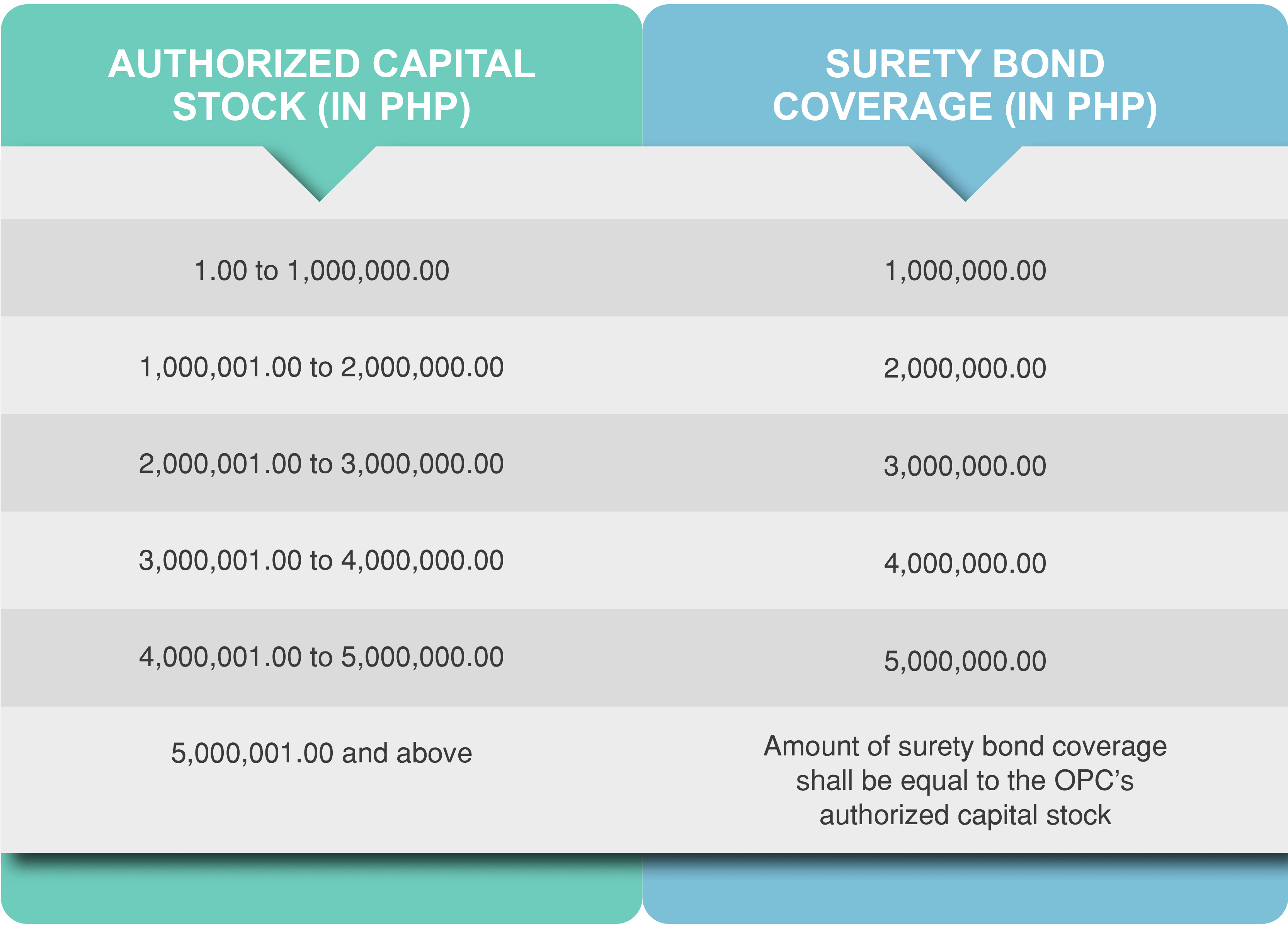

What is the Bond Requirement for the Self-Appointed Treasurer?

If the single stockholder assumes the position of the Treasurer, they must post a surety bond to be computed based on the authorized capital stock of the OPC, which can be any of the following:

Who Are Qualified to Form an OPC

The following entities are qualified to act as the single stockholder of an OPC:

- Natural person of legal age (local or foreign*)

- Trust**

- Estate

*A foreign natural person may set up an OPC, subject to limitations in areas of investment partially or wholly restricted from foreign participation or as specified in the Foreign Investment Negative List (FINL).

**The trust does not refer to a trust entity, but to the subject being managed by a trustee.

Who Are Not Qualified to Form an OPC

Pursuant to the guidelines issued by SEC, the following are not allowed to incorporate an OPC:

- Natural persons licensed to exercise a profession***

- Banks, non-bank financial institutions, and quasi-banks

- Pre-need, trust, and insurance companies

- Non-chartered Government-Owned and/or Controlled Corporations (GOCCs)

- Public and publicly-listed companies

***If the purpose of setting up the OPC is to exercise their profession.

Documentary Requirements for Registering an OPC

Entities seeking to incorporate an OPC must submit the following documents to SEC:

- Articles of Incorporation (Natural Person, Trust or Estate)

- Written Consent from the Nominee and Alternate Nominee

- Other requirements (if applicable)

- Proof of Authority to Act on Behalf of the Trust or Estate (for trusts and estates incorporating as OPC)

- Foreign Investments Act (FIA) Application Form (for foreign natural persons)

- Affidavit of Undertaking to Change Company Name (in case not incorporated in the Articles of Incorporation)

- Tax Identification Number (TIN) for Filipino single stockholder

- Tax Identification Number (TIN) or Passport Number for Foreign single stockholder

Filing Fees for Registering an OPC

- Name Reservation – ₱100.00 per company name and/or trade name

- Articles of Incorporation – 1/2 of 1% of the authorized capital stock but not less than ₱2,000.00

- Legal Research Fee (LRF) – 1% of the Registration/Filing Fee but not less than ₱20.00

- FIA Application Fee – ₱3,000.00 if the single stockholder is a foreigner

- Documentary Stamp – ₱30.00

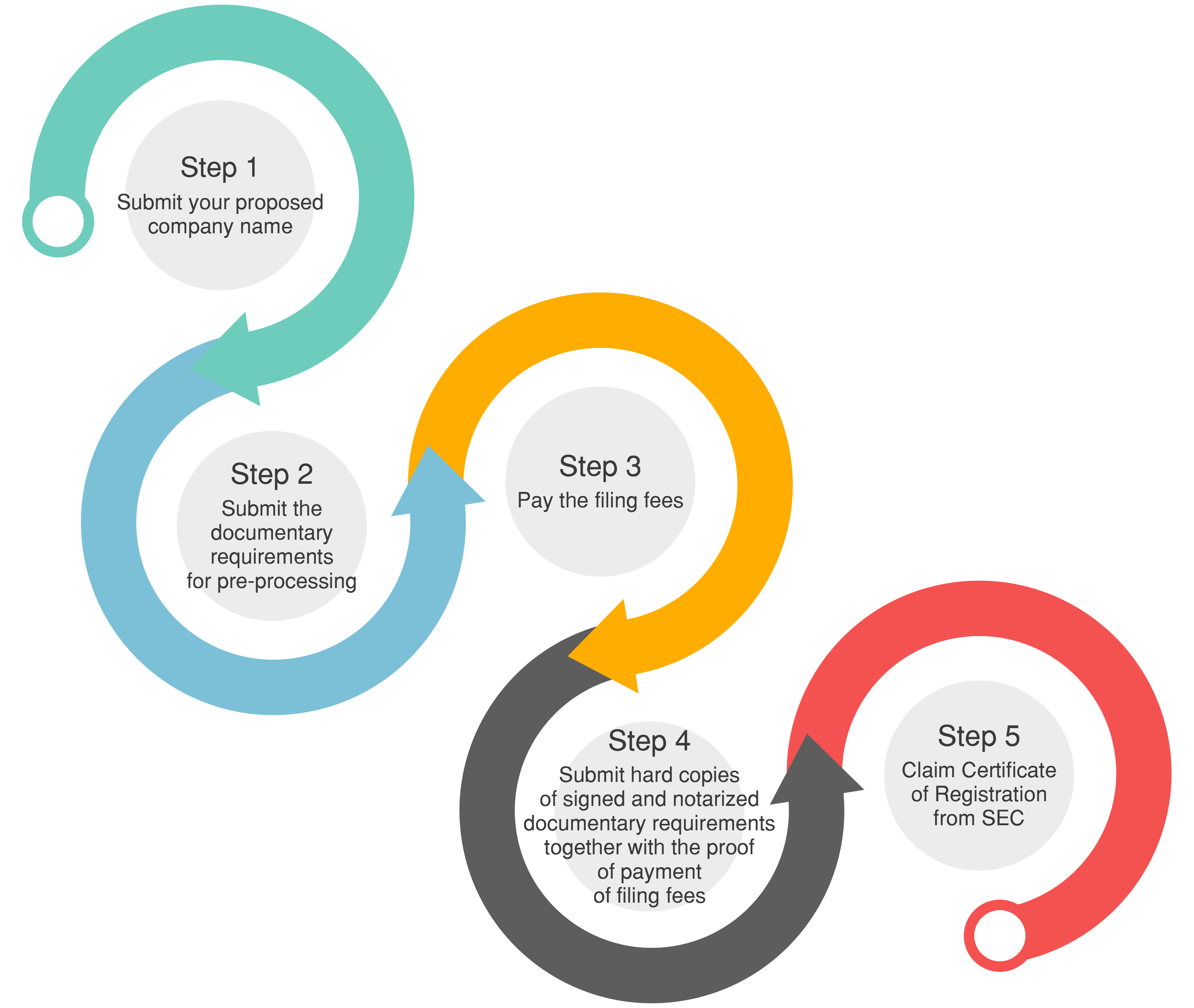

Step-by-Step Process for Registering an OPC

All applications for registering an OPC must be filed manually with SEC’s Company Registration and Monitoring Department (CRMD). The registration process has five steps:

NOTES

- Applicants with rejected company names should submit a Letter of Appeal to SEC.

- Within 15 days from the issuance of the Certificate of Registration, the single stockholder must appoint a treasurer, corporate secretary, and other officers. Thereafter, they must notify SEC of the appointment within 5 days.

Register a One Person Corporation with Speed and Ease

We provide company formation and corporate compliance services to companies of all sizes in the Philippines.