Complete Guide on How to Register a Regional Headquarters (RHQ) in the Philippines

Foreign corporations seeking to set up a communications center to supervise, inspect, or coordinate their subsidiaries, branches, and affiliates around the world can set up a Regional or Area Headquarters (RHQ) in the Philippines.

An RHQ does not have a separate legal entity from its parent company and cannot derive income from any sources to and from the Philippines. Its liabilities will be incurred by the head office.

Subject to restrictions, it can source raw materials, market products, train employees, or conduct research and development projects in the Philippines.

Similar to a Regional Operating Headquarters (ROHQ), an RHQ can only be set up by a foreign corporation with subsidiaries, branches, and/or affiliates around the world.

Setup Requirements

Foreign corporations seeking to set up an RHQ in the Philippines must fulfill the following:

- Appointment of a Resident Agent

- Proof of Official Business Address

Appointment of a Resident Agent

The foreign parent company is required to appoint a Resident Agent who shall receive summons and other legal proceedings served to or against the RHQ in the Philippines. The resident agent can be an individual residing in the Philippines or a domestic corporation lawfully doing business in the country.

Proof of Official Business Address

You need to have a registered office address before starting the company registration process. You must present the Contract of Lease of your office address to the Bureau of Internal Revenue (BIR) and local government units (LGUs) to fulfill this requirement.

If you will not be able to secure your Contract of Lease during the registration process, you can rent a virtual office as your business address. You can transfer to a physical office after completing the registration process.

Minimum Capital Requirements

The minimum paid-up capital for setting up an RHQ in the Philippines is US$50,000. The parent company is required to remit this amount every year to support operating expenses.

Restrictions

An RHQ is not allowed to manage the operations of its parent company’s subsidiaries, branches, and/or affiliates. It is also prohibited to offer services to third parties within and outside the Philippines.

In addition, it is not allowed to deal directly or do business with its parent company’s clients in the Philippines. Its parent company is also not permitted to sell or market products through the RHQ.

Available Incentives for RHQs in the Philippines

As a non-income generating entity, an RHQ is exempted from paying income and value-added taxes but can avail of tax incentives from the Board of Investments (BOI) on its local fees, importation, and employee compensation, to name a few.

RHQs in the Philippines can avail of the following tax incentives:

Tax Incentives

- Exemption from all local taxes, fees, or charges imposed by the LGU of your business address (except real property tax on land improvements and equipment)

- Tax and duty-free importation of equipment and materials not locally available for training and conferences

- Equipment disposed within 2 years after importation (subject to payment of taxes and duties)

- Importation of brand new motor vehicles (subject to payment of taxes and duties)

Tax Incentives for Foreign Personnel

- Preferential tax rate of 15% on salaries, annuities, and other types of compensation applicable for expatriates

- Travel tax exemption

- Multiple Entry Visa

- For expatriates, including their spouse and unmarried children below the age of 21

- Exemption from payment of fees except for reasonable administrative costs

- Exemption from securing Alien Certificate of Registration

- Non-immigrant visa will be processed within 72 hours upon submission of requirements to the Bureau of Immigration (BI)

- Tax and duty-free importation of used household goods and personal effects

Registration Requirements

Foreign corporations seeking to set up an RHQ in the Philippines must provide the following documentary requirements:

- Application Form

- Name Verification Slip

- Certification from the Philippine Consulate/Embassy or the Philippine Commercial Office or from the equivalent office of the Philippine Department of Trade and Industry (DTI) in the parent company’s country of origin verifying that said foreign corporation is engaged in international trade with subsidiaries, branches, or affiliates around the world; in case the certification is issued by an equivalent of DTI, the same shall be authenticated by the Philippine Consulate/Embassy

- Certification from the Principal Officer of the foreign corporation verifying that it was authorized to establish an RHQ in the Philippines

- Proof of inward remittance of US$50,000 as paid-up capital and annual support for operating expenses

- Endorsement or clearance from appropriate government agencies (if applicable)

- Endorsement from the Board of Investments (BOI)

- Latest authenticated financial statements showing the financial solvency of the head office

Registration Timeline

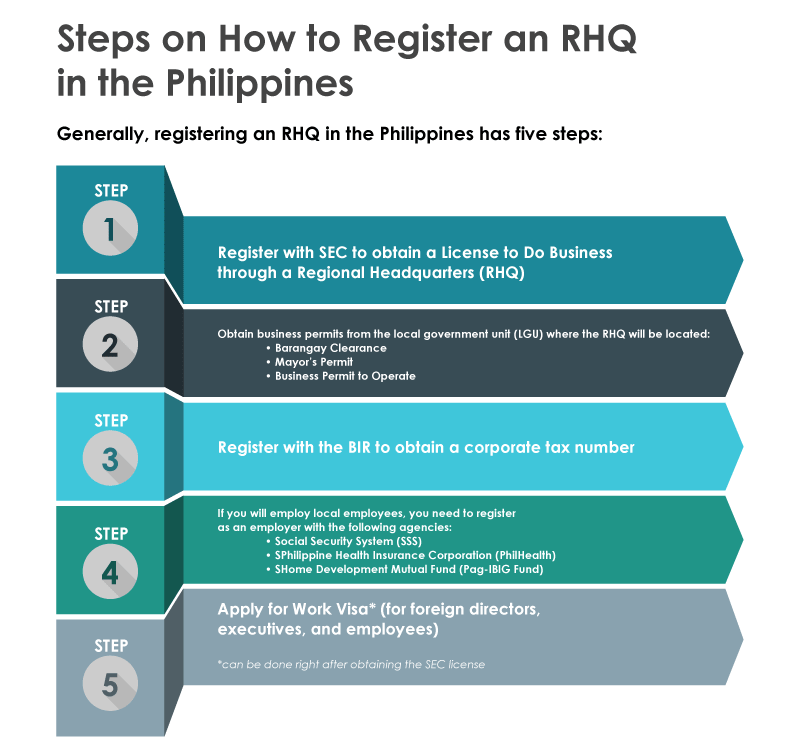

The usual timeline for registering an RHQ in the Philippines is 6-10 weeks, provided all required documents are submitted ahead of time and there are no processing delays from the government.

Want to Register an ROHQ in the Philippines?

We provide transparent, hassle-free foreign corporation licensing services to help you set up your ROHQ in the Philippines with ease.

- Business Registration Services in the Philippines

- Register a Domestic Corporation in the Philippines

- Shelf Company Purchase Services

- Nominee Director Services

- Corporate Bank Account Opening Services

- Capital Requirements for Company Formation in the Philippines

- Assistance for Tax Incentives Application in the Philippines