Complete Guide on How to Register A Representative Office in the Philippines

Foreign corporations seeking to test their potential in the Philippine market before making any significant investments can establish a Representative Office. This business entity can be set up as a liaison office, contact center, or marketing hub to provide operational support to its head office abroad.

Under Philippine laws, a Representative Office is not allowed to generate income from sources within and outside the Philippines. It can only perform activities similar to the following:

- Facilitation of orders from the head office’s clients

- Dissemination of information and conduct of promotional activities about company products

- Undertaking of quality control of company products

- Undertaking of other related administrative activities from the head office

Similar to a Branch Office, it has no separate legal entity from its parent company and any liabilities it will incur are considered liabilities of the head office.

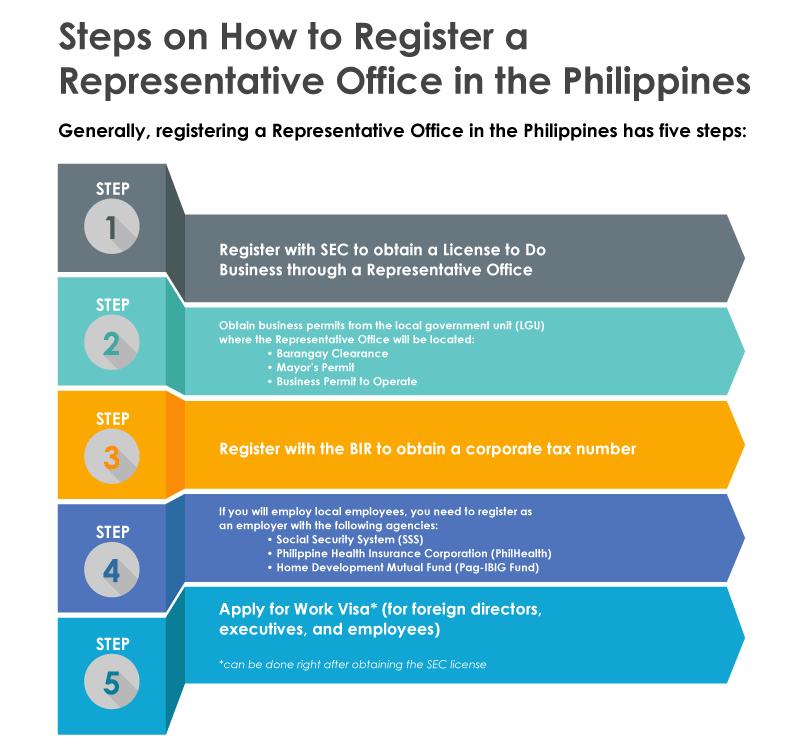

The first step to register a Representative Office in the Philippines is securing a License to Do Business from the Securities and Exchange Commission (SEC). An SEC license allows the foreign parent company to legally establish presence or operations in the Philippines through a Representative Office.

Setup Requirements

Foreign corporations seeking to set up a Representative Office in the Philippines must fulfill the following:

- Appointment of a Resident Agent

- Proof of Official Business Address

Appointment of a Resident Agent

The foreign parent company is required to appoint a Resident Agent who shall receive summons and other legal proceedings served to or against the Representative Office in the Philippines. The resident agent can be an individual residing in the Philippines or a domestic corporation lawfully doing business in the country.

Proof of Official Business Address

You need to have a registered office address before starting the company registration process. You must present the Contract of Lease of your office address to the Bureau of Internal Revenue (BIR) and local government units (LGUs) to fulfill this requirement.

If you will not be able to secure your Contract of Lease during the registration process, you can rent a virtual office as your business address. You can transfer to a physical office after completing the registration process.

Minimum Capital Requirements

The minimum capital requirements for establishing a Representative Office is US$30,000. The foreign parent company is required to remit this amount annually to support operating expenses.

Restrictions

A Representative Office is not allowed to derive income and offer services to third parties. It is also not qualified to apply for tax incentives from the government.

Corporate Taxes for Representative Offices in the Philippines

As a non-income generating entity, a Representative Office is exempted from paying income tax and value-added tax (VAT) to the taxing authority in the Philippines, the Bureau of Internal Revenue (BIR). It is, however, subject to withholding taxes on its remittances to its parent company and employee compensation.

The VAT exemption only applies to VAT directly due from the Representative Office. As such, Representative Offices can be passed on 12% by suppliers for utilities, office rental, professional services, etc.

Under the Tax Reform for Acceleration and Inclusion (TRAIN) law or Republic Act No. 10963, Representative Offices are also constituted as withholding agents with respect to their compensation payments to their local and expatriate employees, the withholding tax rates on compensation are as follows:

- 20-35% graduated tax rates for local employees

- 20-35% graduated tax rates for resident expatriates

- 25% for non-resident expatriates, not engaged in trade or business in the Philippines

A withholding fringe benefit tax rate of 35% of grossed up monetary value under TRAIN law is also required for Representative Offices on fringe benefits to managerial and supervisory employees, as well as filing of related returns and reports.

Registration Requirements

Foreign corporations seeking to set up a Representative Office in the Philippines must submit the following documentary requirements to SEC:

- Application Form

- Name Verification Slip

- Certified copy of the Board Resolution of the parent company authorizing the establishment of the Representative Office and designating a Resident Agent to receive summons and legal proceedings (can be a Philippine resident or foreign national residing in the Philippines)

- Latest audited financial statements of the parent company certified by an independent certified public accountant (CPA) and authenticated by the Philippine Consulate/Embassy

- Certified copies of the Articles of Incorporation of the parent company

- Certificate of Inward Capital Remittance and Certificate of Bank Deposit of US$30,000 as initial capital and annual support for operating expenses

- Acceptance of Appointment of Resident Agent (if agent is not the signatory of the application form)

- Endorsement or clearance from appropriate government agencies (if applicable)

- Affidavit executed by the President or Resident Agent stating that the foreign corporation is solvent and sound in its financial condition

Registration Timeline

The usual timeline for registering a Representative Office in the Philippines is 6-10 weeks, provided all required documents are submitted ahead of time and there are no processing delays from the government.

Need Help With Registering a Representative Office in the Philippines?

We have assisted hundred of foreign corporations in setting up Representative Offices in the Philippines.

- Business Registration Services in the Philippines

- Register a Domestic Corporation in the Philippines

- Shelf Company Purchase Services

- Nominee Director Services

- Corporate Bank Account Opening Services

- Capital Requirements for Company Formation in the Philippines

- Assistance for Tax Incentives Application in the Philippines