SEC Sets Cutoff for Annual Reports Filing in the Philippines

The deadlines for firms to submit their annual reports this year have been set by the Securities and Exchange Commission (SEC).

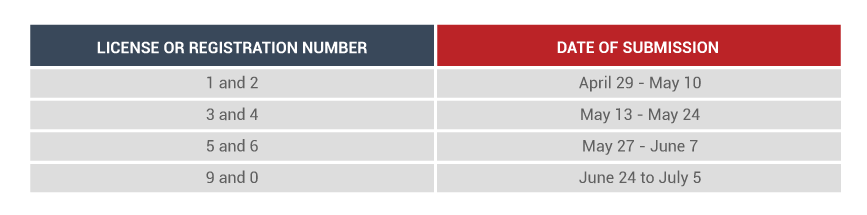

The SEC stated that all entities, as well as branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporations whose fiscal years ended on December 31, 2023, are required to file their annual financial statements (AFS) according to a schedule based on the last digit of their respective registration or license number.

Companies whose license or registration number ends in one or two may submit between April 29 and May 10, and those whose license or registration number ends in three or four may submit between May 13 and May 24.

The dates of submission for registration numbers ending in five and six are set for May 27 to June 7. For registration numbers ending in seven and eight, June 10 to June 21, and for registration numbers ending in nine and zero, June 24 to July 5.

In addition, the SEC noted that corporations whose fiscal year ended on a date other than December 31, 2023, should file their AFS within 120 calendar days from the end of its fiscal year.

Meanwhile, broker-dealers whose fiscal years conclude on December 31 are required to file their annual reports by April 30. Those whose fiscal years end on a date other than December 31 are required to file their reports 120 calendar days following the closure of their respective fiscal years.

The AFS must be filed as an attachment to annual reports within 105 calendar days of the end of each fiscal year for corporations whose securities are listed on the Philippine Stock Exchange (PSE), for those whose securities are registered but not listed on the PSE, for public companies, and for those covered by Section 17.2 of the Securities Regulation Code.

The SEC cited that companies whose AFS is being audited by the Commission on Audit are excused from the deadlines as long as they include with their AFS a properly signed affidavit certifying that, among other things, they promptly gave the COA access to the financial statements and supporting documentation.

SEC mentioned, “Failure to follow the formal requirements prescribed under Revised SRC Rule 68 shall be considered a sufficient ground for the imposition of penalties by the SEC. The acceptance and receipt by the commission of the financial statements shall be without prejudice to such penalties.”

In the meantime, corporations’ general information sheets (GIS) have to be submitted within 30 calendar days of the date of the actual annual shareholders’ meeting for stock corporations, the date of the actual annual members meeting for non-stock corporations, and the anniversary date of the SEC license issuance for foreign corporations.

According to the SEC, One person corporations are exempted from filing the GIS; nevertheless, they must file the SEC Form for officer appointment no later than 15 days after the date on which their certificate of incorporation was issued, or 5 days after any subsequent modifications.