InCorp Philippines and Carpo Law & Associates, in partnership with the British Chamber of Commerce Philippines, brings you “Doing Business in the Philippines”. This covers discussions on how new updates and issuances from the SEC, PhilHealth, and BIR will affect current business operations, as well as projections on how the newly implemented TRAIN Law will channel favorable changes in the current Philippine business climate.

TRAIN Law

By Venus Angelli David Business in the Philippines

President Rodrigo Duterte vetoed five provisions from the Tax Reform for Acceleration and Inclusion (TRAIN) Act before he signed it into law as Republic Act No. 10963 in December 2017.

InCorp Philippines, in partnership with the British Chamber of Commerce of the Philippines, brings you “THE TRAIN LAW: GETTING TRACTION“. This covers a business briefing on the newly implemented Tax Reform Acceleration and Inclusion (TRAIN) Law, Republic Act 10963.

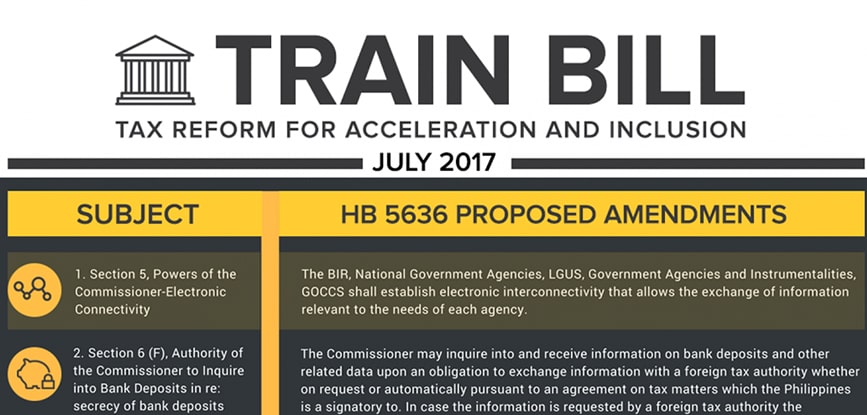

The BIR, National Government Agencies, LGUS, Government Agencies and Instrumentalities, GOCCS shall establish electronic interconnectivity that allows the exchange of information relevant to the needs of each agency.