2023 Updates on Tax, SSS, and PHIC in the Philippines

As we enter the new year, we want to inform you about the PHIC contribution rates together with the 2023 Tax and SSS table.

PHIC Contribution Update

The administration has directed the Philippine Health Insurance Corporation (PhilHealth) to hold up the increase of premium rates and income ceiling this 2023 as Filipinos still struggle with the effects of the pandemic.

The memorandum from the Office of the President ordered the suspension of the scheduled increase of the premium rate from 4% to 4.5% as well as the increase of income ceiling of those paying the highest contribution from ₱80,000 to ₱90,000.

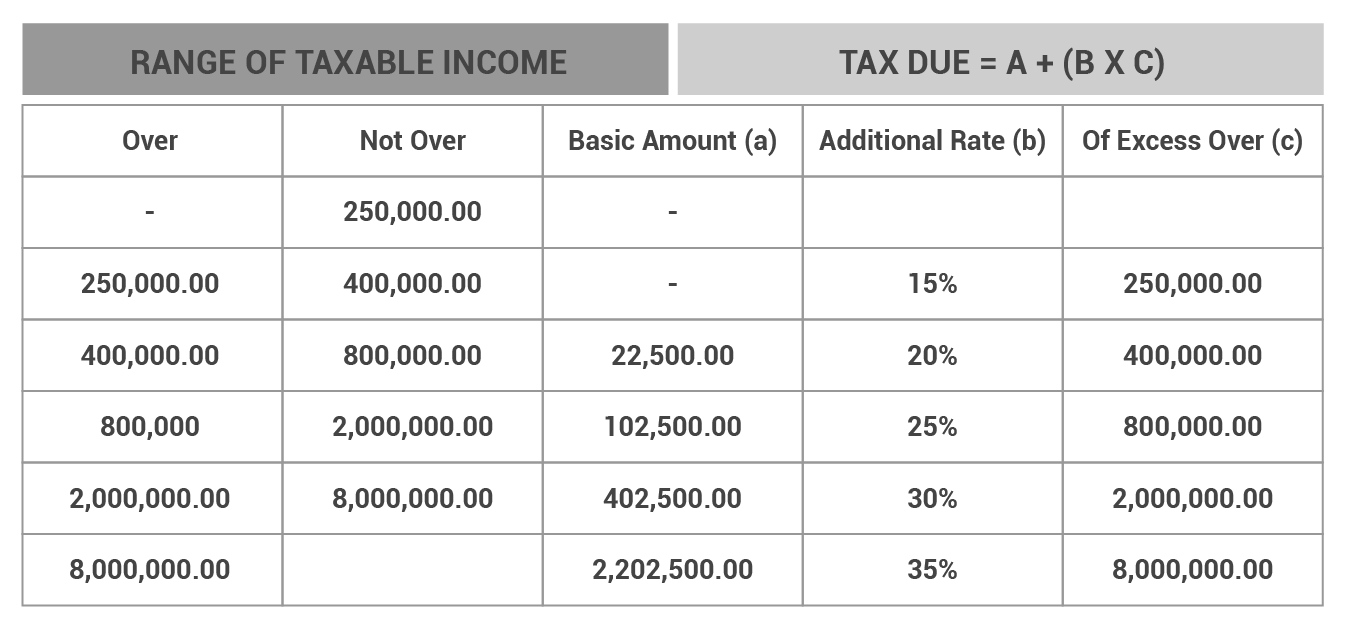

2023 BIR Tax Table

The Bureau of Internal Revenue (BIR) has released an advisory that Individuals Earning Purely Compensation Income can expect bigger take-home salaries this 2023 as there will be an amended tax rate.

Below is the new tax table, effective starting January 1, 2023, and onwards:

Under the adjusted tax rates, individuals with an annual taxable income of ₱250,000 – Below will still be free from paying personal tax.

On the other hand, those earning more than ₱250,000 to ₱8,000,000 will have 15% – 30% tax rates, while those earning above ₱8,000,000 will remain with a 35% tax rate.

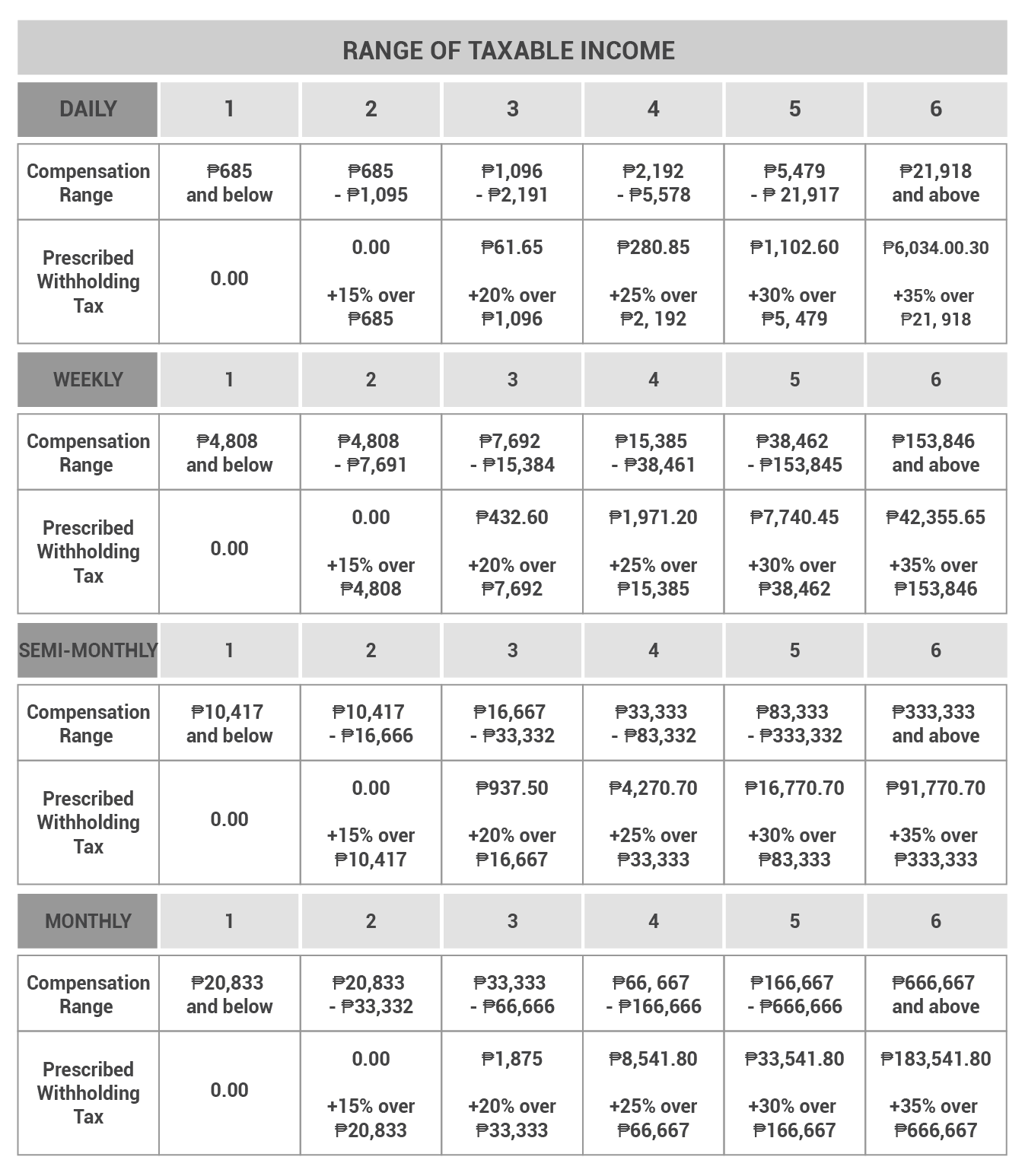

To give you an easier example, below is the revised withholding tax for the daily, weekly, semi-monthly, and monthly computation:

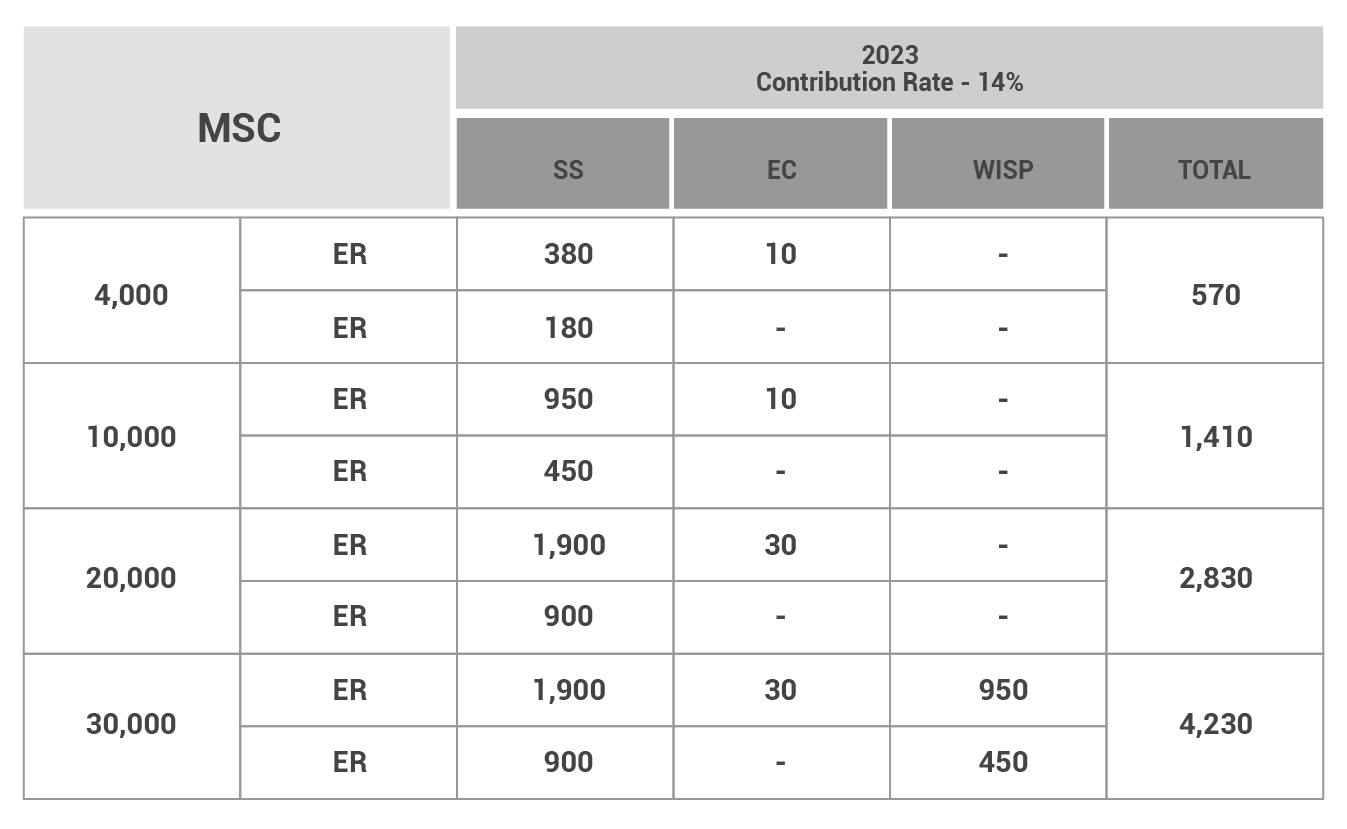

2023 SSS Contribution Table

In accordance with RA 11199, otherwise known as the Social Security Act of 2018. Starting January 2023, the members’ contributions will increase from 13% to 14%.

The 1% increase will be shouldered by the employer. However, the minimum and maximum monthly salary credits (MCS) of the members will also be adjusted and will be the basis for the member’s Workers Investment and Savings Program (WISP) contribution.

Below is the latest SSS contribution table, effective this January 2023:

Wisp is the latest retirement savings plan for the agency’s members. This is also a tax-free savings and investment program that will bring earnings.

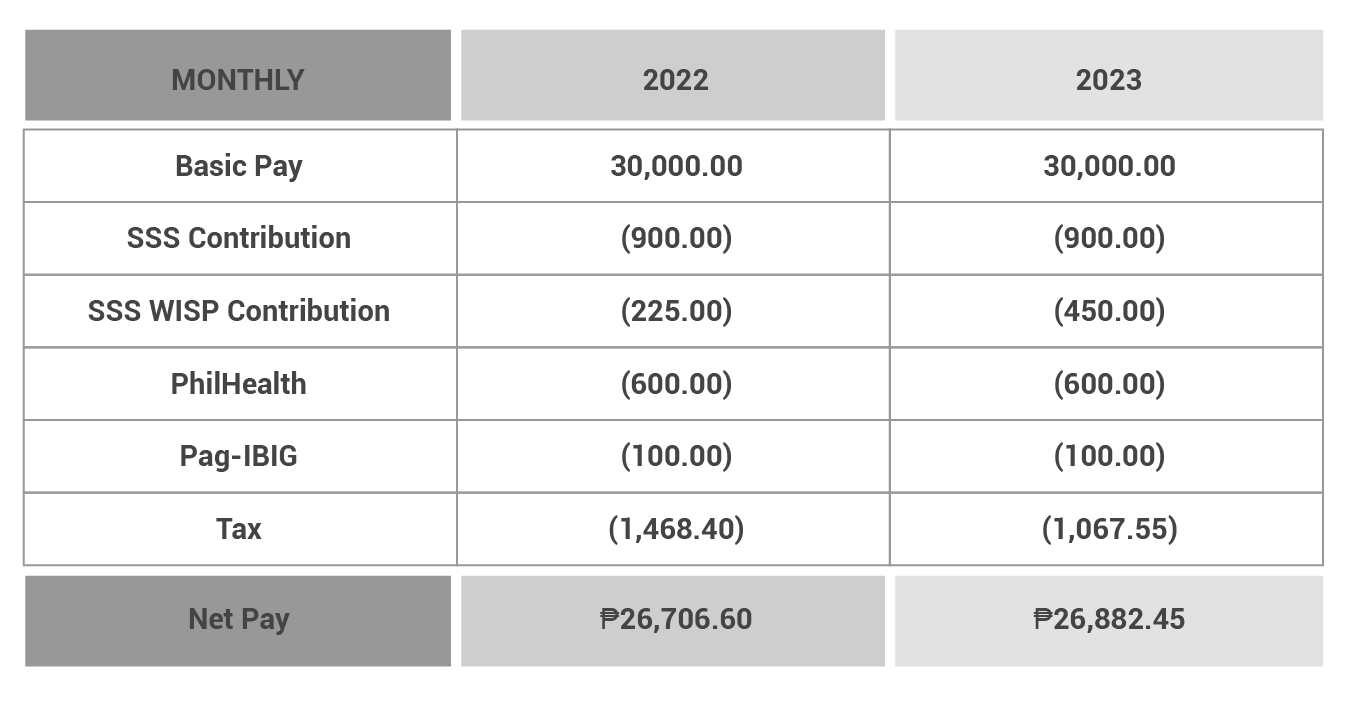

Sample Computation

The SSS and Tax update this 2023 will create changes to an employee’s take-home pay as it will adjust the entire computation of benefits and personal tax.

To give you a more detailed view of the updated SSS and Tax table, here is a sample computation:

The updated tax has given employees higher take-home pays. While the latest 1% SSS contribution increase will not entirely affect the employee’s salary, as this will be shouldered by the company.

Meanwhile, Pag-IBIG has not yet released any newer rules and regulations concerning contribution hikes.

To get more in-depth access to these new government updates, you may refer to the sources below.

Know More About the Tax, SSS, and PHIC Updates for 2023

With the released updates on Tax, SSS, and PHIC this 2023, our team is dedicated to assisting you to understand and implement the following adjustments.