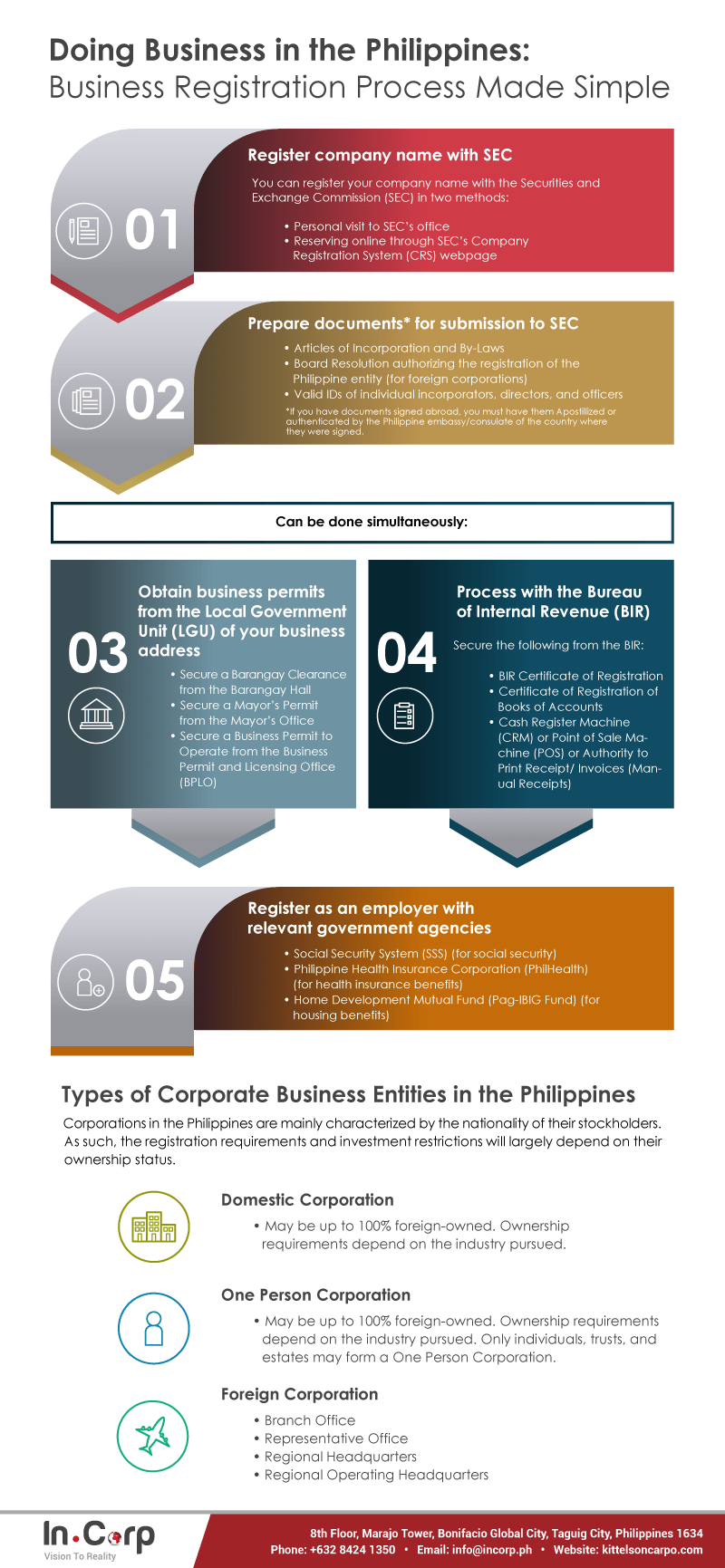

Doing Business in the Philippines: Business Registration Process Made Simple 2024

1. Register business name with SEC

You can register your company name with the Securities and Exchange Commission (SEC) in two methods:

- Personal visit to SEC’s office

- Reserving online through SEC’s Company Registration System (CRS) webpage

2. Prepare documents* for submission to SEC

- Articles of Incorporation and By-Laws

- Board Resolution authorizing the registration of the Philippine entity (for foreign corporations)

- Valid IDs of individual incorporators, directors, and officers

*If you have documents signed abroad, you must have them Apostillized or authenticated by the Philippine embassy/consulate of the country where they were signed.

Steps 3 and 4 can be done simultaneously:

3. Obtain business permits from the Local Government Unit (LGU) of your business address

- Secure a Barangay Clearance from the Barangay Hall

- Secure a Mayor’s Permit from the Mayor’s Office

- Secure a Business Permit to Operate from the Business Permit and Licensing Office (BPLO)

4. Process with the Bureau of Internal Revenue (BIR)

Secure the following from the BIR:

- BIR Certificate of Registration

- Certificate of Registration of Books of Accounts

- Cash Register Machine (CRM) or Point of Sale Machine (POS) or Authority to Print Receipt/Invoices (Manual Receipts)

5. Register with relevant government agencies

- Social Security System (SSS) (for social security)

- Philippine Health Insurance Corporation (PhilHealth) (for health insurance benefits)

- Home Development Mutual Fund (Pag-IBIG Fund) (for housing benefits)

Types of Corporate Business Entities in the Philippines

Corporations in the Philippines are mainly characterized by the nationality of their stockholders. As such, the registration requirements and investment restrictions will largely depend on their ownership status.

Domestic Corporation

- May be up to 100% foreign-owned. Ownership requirements depend on the industry pursued.

One Person Corporation

- May be up to 100% foreign-owned. Ownership requirements depend on the industry pursued. Only individuals, trusts, and estates may form a One Person Corporation.

Foreign Corporation

- Complete Guide on How to Register a Business in the Philippines

- How to Register a One Person Corporation in the Philippines

- Complete Guide on How to Register a Branch Office in the Philippines

- How to Register a Representative Office in the Philippines

- How to Renew Your Business Permits in the Philippines

- Tips on How to Avoid the Stress of Tax Season in the Philippines

Get started on registering your business in the Philippines with us

InCorp Philippines has registered hundreds of local and foreign companies in the Philippines. Our full spectrum of corporate services is guaranteed to help you enjoy a seamless business registration process.